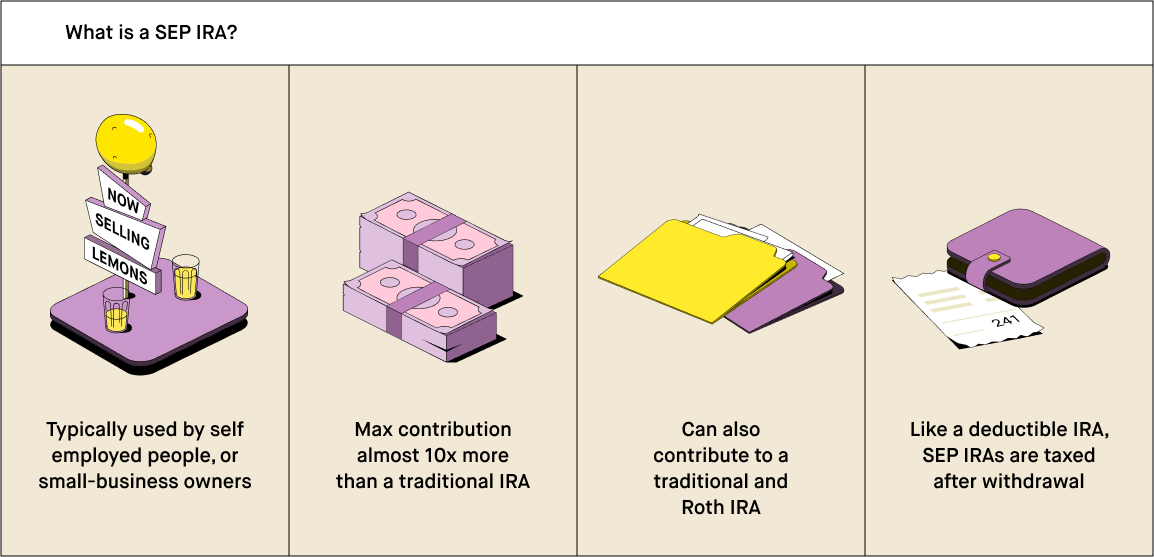

Because a sep ira is a traditional ira you may be able to make regular annual ira contributions to this ira rather than opening a separate ira account.

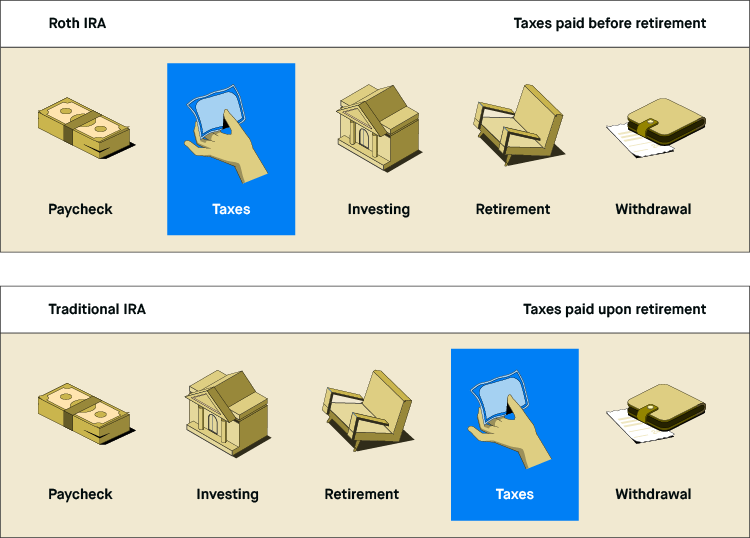

Can i open a sep ira and a roth ira.

You can use your self employment income to fund the sep ira.

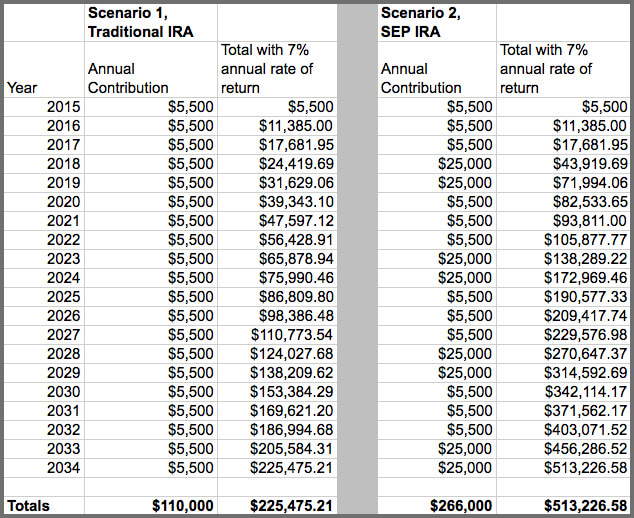

Sep iras however come with much higher annual contribution limits than traditional iras and roth iras.

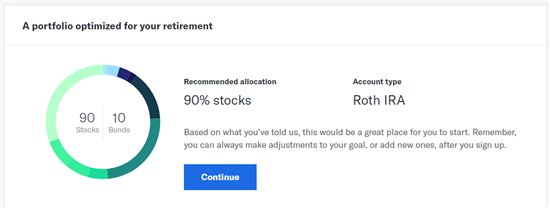

With a traditional or a roth ira an individual s contributions are generally limited to 6 000 a year in 2019 and 2020 or 7 000 for those age 50 and older.

However any dollars you contribute to the sep ira will reduce the amount you can contribute to other iras including roth iras for the year.

You can set aside as much as 25 of your employees compensation footnote 1 up to 57 000 in 2020 56 000 for 2019 to the sep for all eligible employees.

Because a sep ira is a traditional ira you may be able to make regular annual ira contributions to this ira rather than opening a separate ira account.

Currently you can contribute up to 25 of your salary or 25 of your net business.

The contributions will be eligible if your child has a part time job or earns money from babysitting.

So let s say you have a regular 9 to 5 that sponsors a 401 k plan but you also run a side business.

You can even invest in both as well as a 401 k.

/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)

:max_bytes(150000):strip_icc()/iStock-514516902.kroach.roth.cropped-6c3cb0a5419b402a8175c4dc1317bfe7.jpg)

:max_bytes(150000):strip_icc()/GettyImages-592232681-8b341e1080f541f6b2fd0d63c666ea67.jpg)